U.S. Markets

Stocks added to their strong year-to-date gains in July as investors cheered decelerating inflation, better-than-expected corporate earnings, and healthy economic data.

The Dow Jones Industrial Average gained 3.35 percent, while the Standard & Poor’s 500 Index rose 3.11 percent. The Nasdaq Composite, which has led all year, advanced 4.05 percent. [1]

Positive Inflation Reports

After a faltering start to the month, stocks rallied on favorable June inflation data. Consumer prices increased at the slowest rate in over two years, rising just 3 percent year-over-year. This encouraging report was followed by a smaller-than-forecast 0.1 percent rise in June producer prices (an indicator of future consumer prices).

The deflationary trend was further evidenced when the personal consumption expenditures price index, a key inflation measure watched by the Federal Reserve (Fed), rose 0.1 percent month-over-month and 4.1 percent from 12 months ago—the lowest annual increase since September 2021. [2,3]

Support from Earnings

Second-quarter earnings also boosted investor optimism last month. With 51 percent of S&P 500 companies reporting, 80 percent have reported earnings above Wall Street estimates, which is above the 5- and 10-year averages. The earnings beat in the second quarter was less impressive, however, averaging 5.9 percent, which is below the 5- and 10-year averages. [4]

Investors greeted the results with relief since the second quarter is traditionally a low point for corporate results. A number of industry sectors showed solid earnings growth, and some investors saw this as evidence of a healthy consumer and a potential sign of improving earnings in the second half of the year. [4]

Recession Fades

Finally, the overhang of a possible recession this year faded over the course of the month. Even Fed Chair Jerome Powell, following the Fed’s July meeting, remarked that the Fed no longer expected a recession this year. [5]

One of the most remarkable aspects about the market was that the Fed, as expected, raised interest rates 0.25 percent at its July meeting—and indicated that a future rate hike was not off the table—and the markets appeared to barely notice.

Sector Scorecard

All industry sectors ended in the green last month, with gains in Communications Services (+5.70 percent), Consumer Discretionary (+2.31 percent), Consumer Staples (+2.13 percent), Energy (+7.77 percent), Financials (+4.81 percent), Health Care (+1.07 percent), Industrials (+2.89 percent), Materials (+3.44 percent), Real Estate (+1.33 percent), Technology (+2.58 percent), and Utilities (+2.49 percent). [6]

What Investors May Be Talking About in August

Global central bank governors will be gathering at the Federal Reserve Bank of Kansas City’s annual Economic Policy Symposium in Jackson Hole on August 24-26.

This year’s discussion will center on structural shifts in the global economy. But investors will be focused on Fed Chair Powell’s comments on his monetary policy outlook for the coming months.

Markets Prepare for Powell

At last year’s meeting, Powell’s speech was viewed by the financial markets as especially hawkish, triggering a sell-off with S&P 500 falling 3.37 percent. [7]

As August progresses, investors will be keenly watching the labor market and inflation since both may be key data points guiding Powell’s remarks in Jackson Hole. Any indications by Powell that the Fed may pause or stay the course may unsettle the markets.

World Markets

The MSCI EAFE Index gained 3.17 percent in July, aided by slowing inflation in Europe and China’s announcement of support for its troubled property market. [8]

European markets were higher, with gains in France (+1.32 percent), Germany (+1.85 percent), Italy (+5.01 percent), Spain (+0.51 percent), and the United Kingdom (+2.23 percent). [9]

Pacific Rim markets were mixed. China’s Hang Seng Index picked up 6.15 percent, and Australia’s ASX 200 added 2.88 percent. However, Japan was flat (-0.05 percent). [10]

Indicators

Gross Domestic Product (GDP)

The U.S. economy expanded by a 2.4 percent annualized rate in the second quarter. This was higher than the first quarter’s GDP growth rate of 2.0% and well above the consensus forecast. [11]

Employment

Employers added 209,000 new jobs in June, a sharp deceleration from May’s revised 306,000 new hires. The unemployment rate fell to 3.6 percent, while average hourly wages grew 4.4 percent from a year ago. [12]

Retail Sales

Retail sales rose 0.2 percent, falling short of economists’ consensus forecast of a 0.5 percent increase. [13]

Industrial Production

Industrial production fell 0.5 percent in June. Despite falling for the second consecutive month, industrial production increased at an annualized rate of 0.7 percent in the second quarter. [14]

Housing

Housing starts tumbled 8.0 percent in June and were 8.1 percent lower than a year ago. Permits to build, an indicator of future new housing starts, also declined, slipping 3.7 percent from May. [15]

Sales of existing homes fell by 3.3 percent in June, owing to the continued tight inventory of homes on the market. [16]

New home sales contracted by 2.5 percent month-over-month, while increasing 23.8 percent from last June. [17]

Consumer Price Index (CPI)

The rise in consumer prices continued their cooling trend, falling to their lowest level in over two years. The CPI rose a modest 0.2 percent in June and 3.0 percent from a year ago. Both came in below economists’ forecasts. Core inflation (excludes food and energy) also decelerated, rising 4.8 percent from last June. [18]

Durable Goods Orders

Orders of goods designed to last three years or more climbed 4.7 percent in June, exceeding the estimate of 1.5 percent. [19]

The Fed

As widely expected, the Fed raised interest rates by a quarter percent point at its July FOMC meeting.

The U.S. central bank made little change to its previous statement in June, where it kept interest rates unchanged. Fed Chair Powell did not rule out on another hike at its September meeting but emphasized that decisions would remain data dependent. [20]

“I would say it’s certainly possible that we will raise funds again at the September meeting if the data warranted,” said Powell after the Fed’s July meeting. “And I would also say it’s possible that we would choose to hold steady, and we’re going to be making careful assessments, as I said, meeting by meeting.” [20]

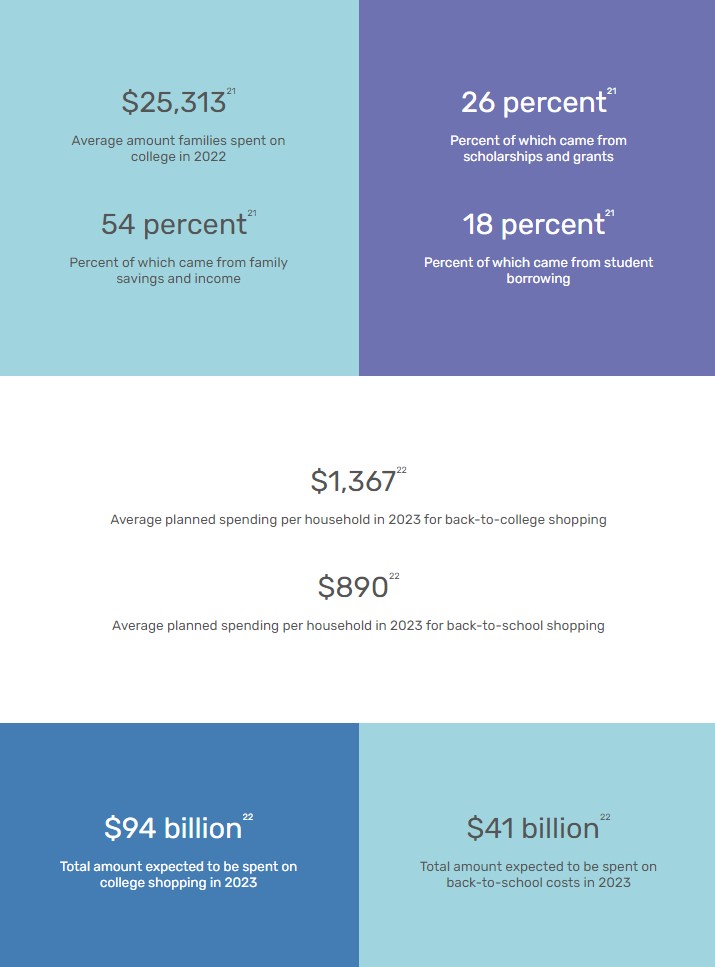

By the Numbers: The Cost of College

Lighthouse Financial, LLC may be reached at www.lighthousefinancialllc.com, 303-444-1818 or wisdom@lighthousefinancialllc.com.

Investment and Advisory services are provided by Petra Financial Advisors, Inc., headquartered at 2 N. Nevada Ave. Suite 1300, Colorado Springs, CO 80903.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite, LLC, is not affiliated with the named representative, broker-dealer, or state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security.

Investing involves risks, and investment decisions should be based on your own goals, time horizon and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

Any companies mentioned are for illustrative purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, timeframe, and risk tolerance.

The forecasts or forward-looking statements are based on assumptions, subject to revision without notice, and may not materialize.

The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. The S&P 500 Composite Index is an unmanaged group of securities considered to be representative of the stock market in general. The Nasdaq Composite is an index of the common stocks and similar securities listed on the Nasdaq stock market and considered a broad indicator of the performance of stocks of technology and growth companies. The Russell 1000 Index is an index that measures the performance of the highest-ranking 1,000 stocks in the Russell 3000 Index, which is comprised of 3,000 of the largest U.S. stocks. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark for the performance in major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. The return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

The Hang Seng Index is a benchmark index for the blue-chip stocks traded on the Hong Kong Stock Exchange. The KOSPI is an index of all stocks traded on the Korean Stock Exchange. The Nikkei 225 is a stock market index for the Tokyo Stock Exchange. The SENSEX is a stock market index of 30 companies listed on the Bombay Stock Exchange. The Jakarta Composite Index is an index of all stocks that are traded on the Indonesia Stock Exchange. The Bovespa Index tracks 50 stocks traded on the Sao Paulo Stock, Mercantile, & Futures Exchange. The IPC Index measures the companies listed on the Mexican Stock Exchange. The MERVAL tracks the performance of large companies based in Argentina. The ASX 200 Index is an index of stocks listed on the Australian Securities Exchange. The DAX is a market index consisting of the 30 German companies trading on the Frankfurt Stock Exchange. The CAC 40 is a benchmark for the 40 most significant companies on the French Stock Market Exchange. The Dow Jones Russia Index measures the performance of leading Russian Global Depositary Receipts (GDRs) that trade on the London Stock Exchange. The FTSE 100 Index is an index of the 100 companies with the highest market capitalization listed on the London Stock Exchange.

Please consult your financial professional for additional information.

Copyright 2023 FMG Suite.

- WSJ.com, July 31, 2023

- CNBC.com, July 13, 2023

- CNBC.com, July 28, 2023

- Insight.factset.com, July 28, 2023

- MarketWatch.com, July 26, 2023

- SectorSPDR.com, July 31, 2023

- CNBC.com, August 25, 2022

- MSCI.com, July 31, 2023

- MSCI.com, July 31, 2023

- MSCI.com, July 31, 2023

- CNBC.com, July 27, 2023

- CNBC.com, July 7, 2023

- MarketWatch.com, July 18, 2023

- FederalReserve.gov, July 18, 2023

- Yahoo.com, July 19, 2023

- WSJ.com, July 20, 2023

- Reuters.com, July 26, 2023

- WSJ.com, July 12, 2023

- CNBC.com, July 7, 2023

- WSJ.com, July 26, 2023

- SallieMae, 2022

- NRF.com, 2022