Updated Contribution Limits for 2025

The limits for retirement and savings contributions are reviewed annually based on inflation. While these limits don’t always increase yearly, in 2025, some plans saw incremental adjustments based on inflation. [1]

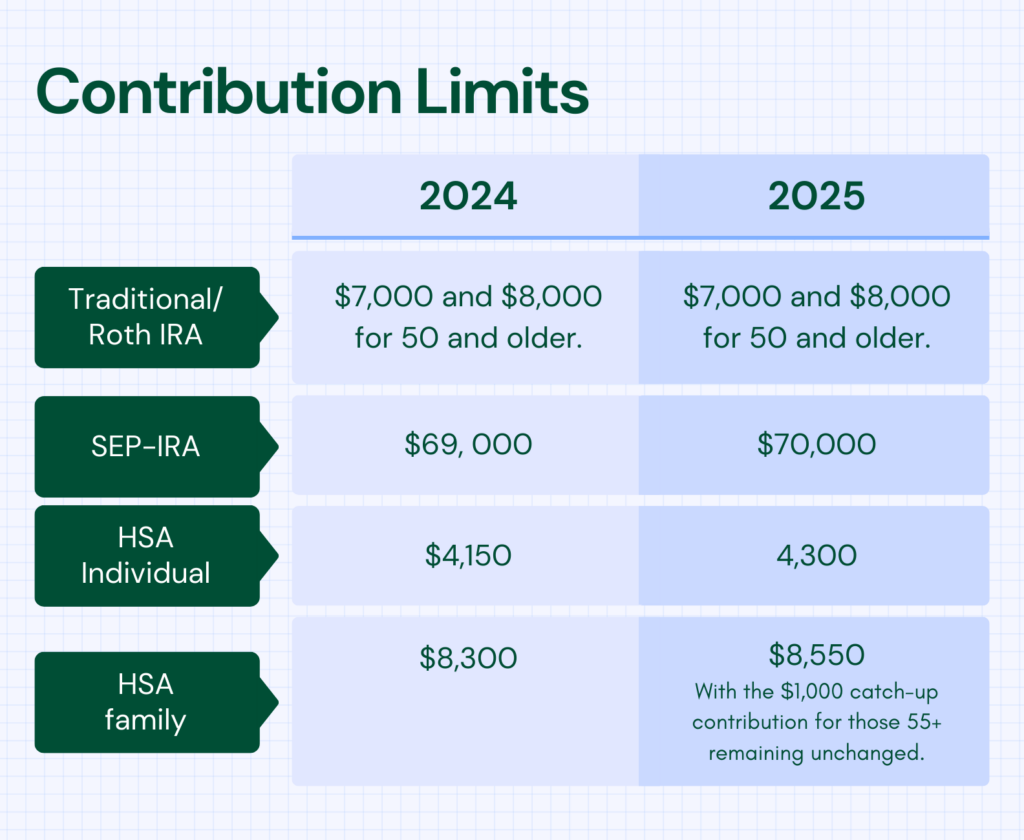

Here are the contribution limits for 2025:

Here are the contribution limits for 2025:

Traditional and Roth IRA Contribution Limits: The IRA contribution limits will remain unchanged for 2025, allowing individuals to contribute $7,000 or $8,000 for those 50 and older. [1]

SEP-IRA Contribution Limits: The SEP-IRA contribution limit will rise from $69,000 in 2024 to $70,000 in 2025. [2]

Health Savings Account (HSA) Contribution Limits: For individual coverage, the HSA contribution limit will increase from $4,150 in 2024 to $4,300 in 2025. For family coverage, the limit will rise from $8,300 to $8,550, with the $1,000 catch-up contribution for those 55+ remaining unchanged. [3]

These adjustments offer opportunities to consider for your retirement savings in 2025. Review your contribution strategies today.

Pro Tips: To qualify for tax-free and penalty-free earnings withdrawals, contributions to a Roth IRA must meet a 5-year holding requirement and occur after age 59½. Tax-free and penalty-free withdrawals can also be taken under certain other circumstances, such as the owner’s death. The original Roth IRA owner is not required to take minimum annual withdrawals.

In most circumstances, once you reach age 73, you must begin taking required minimum distributions from a SEP-IRA and other defined contribution plans. Withdrawals are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty.

Once you start Medicare, you can no longer contribute pretax dollars to your health savings account (HSA). Any money withdrawn from your HSA for a nonmedical reason is considered taxable income and faces an additional 20% penalty. This penalty is void after age 65; however, it would still become taxable income.

Health Tip: Resist the sedentary life

Challenging your muscles through resistance training matters as you age. Resistance training, whether it employs weights, resistance bands, or body weight, can help older people build and maintain their muscles.

Nurturing Relationships: Cultivating Meaningful Connections in Retirement

According to a 2023 sampling of adults aged 50-80 by the University of Michigan’s Institute for Healthcare Policy and Innovation, a third of retirement-age adults describe feelings of isolation. That’s a sobering thought, isn’t it? It’s also a good reason to think today about the connections you will have in retirement. [4]

Here are some ways to foster meaningful relationships and prevent loneliness in retirement:

- Family Time: Reinforcing your connections within your household and extended family is especially important. Reach out and do what you can to strengthen those ties that bind. [5]

- Expand Your Social Network Before Retirement: Building a strong social circle before retirement can help ease the transition. Individuals who maintain regular social interactions before retiring are more likely to sustain these relationships later. [5]

- Create New Connections Beyond Work: If most of your social interactions are tied to work, branching out and building relationships outside of the office is important. Start engaging with neighbors or people who share your interests. [5]

- Volunteer for a Sense of Purpose: Work often gives people a sense of purpose and belonging. In retirement, volunteering can fill that gap by providing an opportunity to contribute to society while combating loneliness. [5]

- Think Twice Before Moving: While moving to a new place in retirement may seem appealing, it can lead to isolation if you leave your social network behind. Relocating may make it harder to form new connections, and you may find yourself missing the support of old friends. [5]

For many people, the workplace is where most social interactions happen. However, once you retire, these interactions often dwindle, leaving retirees needing to find new ways to stay connected and avoid isolation. So, work now to build and sustain those all-important connections.

On the Bright Side

Eight-year-old Emerson Bayse, a heart transplant candidate, developed a craving for salty foods, a common side effect of fluid restrictions in cardiac patients, and became particularly fond of pickles. At Boston Children’s Hospital, where she is a patient, the staff embraced her newfound obsession, with a child life specialist decorating her PICC line with pickle stickers. During her inpatient stay, Emerson met Sarah Bryce, the chef and program manager of culinary services, who engages patients with interactive food experiences. Bryce, who was once a patient at the same hospital, uses cooking to bring joy to the children, conducting activities like cupcake decorating and in-room pickling. When Bryce learned of Emerson’s love for pickles, she organized a pickle-making session, which led to a pickle party with various departments participating. [6]

Lighthouse Financial, LLC may be reached at www.lighthousefinancialllc.com, 303-444-1818 or wisdom@lighthousefinancialllc.com.

Investment and Advisory services are provided by Petra Financial Advisors, Inc., headquartered at 2 N. Nevada Ave. Suite 1300, Colorado Springs, CO 80903.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG, LLC, is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2025 FMG Suite.

- Kiplinger, October 15, 2024

- The Finance Buff, October 10, 2024

- IRS.gov, 2024

- healthyagingpoll.org, March 2023

- U.S. News and World Report, October 15, 2024

- Today, September 23, 2024