U.S. Markets

Stocks posted solid gains in Q4 as investors navigated the presidential election, overseas unrest, and Fed rate cuts.

The Standard & Poor’s 500 Index rose 2.07 percent, while the Nasdaq Composite surged 6.17 percent. By contrast, the Dow Jones Industrial Average edged up only 0.51 percent. [1]

Back and Forth in October

Stocks slipped in October as pre-election jitters hung over trading while solid but not spectacular Q3 corporate reports failed to buoy spirits. [2]

Middle East tensions unsettled investors early in the month. But as the month progressed, investors took a wait-and-see approach. That bumpy beginning gave way to an upbeat jobs report from the Department of Labor, which boosted stocks. The Fed previously told investors that it’s focused on the jobs market as well as inflation, which elevated the importance of the monthly jobs report. [3]

Fed, Inflation Grab Headlines in November

Despite a jittery start to November, stocks rallied following Election Day results and gained momentum following the Federal Reserve’s second consecutive interest rate cut. The S&P 500 crossed the 6,000 mark for the first time, while the Dow breached 44,000. [4,5]

The markets took a breather as investors anxiously awaited fresh inflation data. News that retail and wholesale prices ticked up slightly in October sent markets down, even though both numbers were in line with economists’ expectations. Stocks remained under pressure after unexpected comments from Fed Chair Powell, who said the Fed wasn’t “in a hurry” to cut rates. [6]

Back-to-Back Gains for S&P 500

Markets were a mixed bag in the final month as the Dow Industrials and S&P 500 fell, while the Nasdaq posted a modest gain. The Dow was down 12 of the first 13 trading days of the month, including 10 consecutive sessions that marked its longest losing streak since 1974. [7]

The Fed’s quarter-point cut on December 18 was widely expected. Less expected was Fed Chair Jerome Powell’s signaling of fewer rate reductions next year. Markets fell in response and came under pressure again as a government spending bill appeared to stall in Congress. But a lower-than-expected inflation update boosted the market and helped erase some earlier losses. [8,9]

Despite the sluggish finish, the S&P 500 ended the year up 23 percent—its second consecutive gain of more than 20 percent. [10]

Sector Scorecard

Only 4 of the 11 S&P 500 sectors ended the quarter in the green, but those four sectors were powerful enough to lift the Standard & Poor’s 500 stock index.

Consumer Discretionary (+11.97 percent) was the best-performing sector. The other three positive sectors were Communication Services (+7.09 percent), Financials (+6.64 percent) and Technology (+2.99 percent). Materials (−12.70 percent) and Healthcare (−10.68 percent) were among the worst performers, while Real Estate (−8.95 percent), Utilities (−6.30 percent), and Consumer Staples (−5.29 percent) also finished in the red. Industrials (−2.72 percent) and Energy (−2.44 percent) fell the least. [11]

What Investors May Be Talking About in January

Expect attention to shift to Inauguration Day. Wall Street will be watching to see what policies the White House exacts through executive order and what policies will follow a legislative process.

Updated and stricter tariffs may be implemented quickly by the next administration. Some economists have speculated that the new programs may be inflationary, but others are less concerned, reminding investors that many tariffs have remained in place for the past four years. [12]

However, overseas trading partners appear to be bracing for fresh tariffs. In mid-December, the European Central Bank—anticipating possible U.S. trade tariffs on goods from Europe—cut interest rates for the third time in as many months. And China has toughened its talk around economic stimulus, promising a more proactive fiscal policy and looser monetary policy in anticipation of trade tensions with the incoming U.S. administration. [13,14]

World Markets

The MSCI EAFE Index fell 8.38 percent in Q4, starkly contrasting U.S. averages that benefited from post-election and holiday rallies. [15]

European markets were mixed during the quarter. France fell 3.34 percent, Spain 2.38 percent, and the United Kingdom 1.25 percent. Meanwhile, Germany picked up 3.02 percent and Italy 1.23 percent. [16]

Most emerging markets were under pressure, which accounted for much of the drop in the MSCI EAFE. Brazil dropped 8.75 percent, Mexico 5.65 percent, and India 7.31 percent. [17]

Pacific Rim markets were mixed thanks to Japan, which picked up 5.21 percent during the quarter. Elsewhere, China’s Hang Seng Index dropped 5.08 percent, and Korea’s KOSPI index fell 7.47 percent. [18]

Indicators

Gross Domestic Product (GDP)

The economy grew at an annualized rate of 3.1 percent in the third quarter of 2024, revised upward from the prior estimate of 2.8 percent and ahead of economists’ expectations. That followed 3.0 percent annualized growth in Q2 and 1.6 percent in Q1. [19]

Employment

Employers added 227,000 jobs in November, a rebound from 36,000 jobs added in October (revised up from the initial estimate of 12,000 jobs). The November gain was in line with economists’ expectations and confirmed what investors were hoping—that October was an anomaly due to the outsized impact of two hurricanes and a workers’ strike at a large aircraft manufacturer. [20]

Unemployment increased slightly in November to 4.2 percent, while wage growth increased 4.0 percent over the prior 12 months.

Retail Sales

Consumer spending increased 0.7 percent, beating economists’ expectations of 0.5 percent. Year over year, retail sales rose 3.8 percent. [21]

Industrial Production

Industrial output rose by 0.2 percent in November—less than the 0.5 percent rebound economists expected but better than October. A strong showing in automobile output was countered by continued weakness in aerospace. [22]

Housing

Housing starts fell 1.8 percent—the lowest level in four months. November’s drop was driven by a steep decline in multifamily starts, which offset a gain in single-family starts. [23]

Sales of existing homes rose 4.8 percent in November, thanks in part to lower mortgage rates and additional inventory pulling homebuyers off the sidelines. It was a continuation from October when sales of existing homes rose 3.4 percent. The median existing-home sales price was $406,100, a 4.7 percent increase from a year prior. [24]

New home sales rose 5.9 percent in November. The median new home sales price in November was $402,600, down 6.3 percent from a year prior—the lowest level since February 2022. There were 490,000 unsold new homes on the market in November, representing 8.9 months of inventory. [25]

Consumer Price Index (CPI)

In line with expectations, core consumer prices ticked up 0.3 percent in November. Core CPI, which excludes volatile food and energy prices, was up 3.3 percent year over year—also in line with expectations. [26]

Durable Goods Orders

Orders of manufactured goods designed to last three years or longer fell 1.1 percent in November, mostly due to weakness in commercial aircraft orders. [27]

The Fed

As expected, the Federal Reserve lowered interest rates by a half percentage point in Q4. The Fed Funds Rate target range ended the year at 4.25–4.50 percent.

Fed Chair Jerome Powell took the opportunity at both Q4 FOMC meetings to signal less certainty on the pace and timing of rate adjustments in 2025. Following the December meeting, the Fed Chair said, “From here, it’s a new phase, and we’re going to be cautious about further cuts.” [28,29]

The FOMC’s next meeting is scheduled for January 28–29.

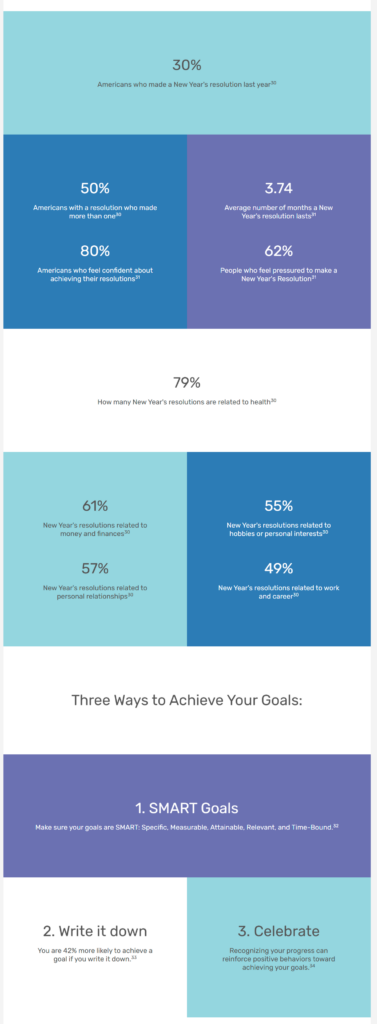

By the Numbers: New Year’s Resolutions

Lighthouse Financial, LLC may be reached at www.lighthousefinancialllc.com, 303-444-1818 or wisdom@lighthousefinancialllc.com.

Investment and Advisory services are provided by Petra Financial Advisors, Inc., headquartered at 2 N. Nevada Ave. Suite 1300, Colorado Springs, CO 80903.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite, LLC, is not affiliated with the named representative, broker-dealer, or state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security.

Investing involves risks, and decisions should be based on your goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost.

Any companies mentioned are for illustrative purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, timeframe, and risk tolerance.

The forecasts or forward-looking statements are based on assumptions, subject to revision without notice, and may not materialize.

The market indexes discussed are unmanaged and generally considered representative of their respective markets. Individuals cannot directly invest in unmanaged indexes. Past performance does not guarantee future results.

The Dow Jones Industrial Average is an unmanaged index that is generally considered representative of large-capitalization companies on the U.S. stock market. The S&P 500 Composite Index is an unmanaged group of securities considered to be representative of the stock market in general. The Nasdaq Composite is an index of the common stocks and similar securities listed on the Nasdaq stock market and considered a broad indicator of the performance of stocks of technology and growth companies. The Russell 1000 Index is an index that measures the performance of the highest-ranking 1,000 stocks in the Russell 3000 Index, which is comprised of 3,000 of the largest U.S. stocks. The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) and serves as a benchmark for the performance in major international equity markets, as represented by 21 major MSCI indexes from Europe, Australia, and Southeast Asia. Index performance is not indicative of the past performance of a particular investment. Past performance does not guarantee future results. Individuals cannot invest directly in an index. The return and principal value of stock prices will fluctuate as market conditions change. And shares, when sold, may be worth more or less than their original cost.

International investments carry additional risks, which include differences in financial reporting standards, currency exchange rates, political risks unique to a specific country, foreign taxes and regulations, and the potential for illiquid markets. These factors may result in greater share price volatility.

The Hang Seng Index is a benchmark index for the blue-chip stocks traded on the Hong Kong Stock Exchange. The KOSPI is an index of all stocks traded on the Korean Stock Exchange. The Nikkei 225 is a stock market index for the Tokyo Stock Exchange. The SENSEX is a stock market index of 30 companies listed on the Bombay Stock Exchange. The Jakarta Composite Index is an index of all stocks that are traded on the Indonesia Stock Exchange. The Bovespa Index tracks 50 stocks traded on the Sao Paulo Stock, Mercantile, & Futures Exchange. The IPC Index measures the companies listed on the Mexican Stock Exchange. The MERVAL tracks the performance of large companies based in Argentina. The ASX 200 Index is an index of stocks listed on the Australian Securities Exchange. The DAX is a market index consisting of the 30 German companies trading on the Frankfurt Stock Exchange. The CAC 40 is a benchmark for the 40 most significant companies on the French Stock Market Exchange. The Dow Jones Russia Index measures the performance of leading Russian Global Depositary Receipts (GDRs) that trade on the London Stock Exchange. The FTSE 100 Index is an index of the 100 companies with the highest market capitalization listed on the London Stock Exchange.

Please consult your financial professional for additional information.

Copyright 2025 FMG Suite.

- WSJ.com, December 31, 2024

- Insight.FactSet.com, November 1, 2024

- WSJ.com, October 4, 2024

- WSJ.com, November 6, 2024

- WSJ.com, November 7, 2024

- Reuters.com, November 14, 2024

- CNBC.com, December 17, 2024

- WSJ.com, December 18, 2024

- APNews.com, December 21, 2024

- CNBC.com, December 31, 2024

- SectorSPDRS.com, December 31, 2024

- TaxFoundation.org, June 26, 2024

- APNews.com, December 12, 2024

- WSJ.com, December 9, 2024

- MSCI.com, December 31, 2024

- MSCI.com, December 31, 2024

- MSCI.com, December 31, 2024

- MSCI.com, December 31, 2024

- APNews.com, December 19, 2024

- WSJ.com, December 6, 2024

- CNBC.com, December 17, 2024

- Reuters.com, December 17, 2024

- Reuters.com, December 18, 2024

- Realtor.com, December 19, 2024

- Realtor.com, December 23, 2024

- The Wall Street Journal, December 11, 2024

- Reuters.com, December 23, 2024

- The Wall Street Journal, November 7, 2024

- The Wall Street Journal, December 18, 2024

- PewResearch.org, January 29, 2024

- Forbes.com, December 18, 2023

- Forbes.com, July 9, 2024

- Entrepeneur.com, April 20, 2024

- PsychologyToday.com, January 17, 2024